Synchronous Mortgage Loan

Bank’s valuation was insufficient, but not want to forfeit the deposit? The Synchronous Mortgage Loan is your choice. Submit the documents in only 3 days before, we will get funds ready for you to complete the deal. Also accepts the application from Inland China intended to acquisition in Hong Kong.

The Synchronous Mortgage Loan Plan is aimed to give assistance to the prospective owners who facing the problem of insufficient valuation of bank or insufficient loan amount. Simple Credit can provide the remaining amount of the insufficient valuation, or applying the property second mortgage, which is synchronizing to the bank’s mortgage loan, for completing the deal on new properties.

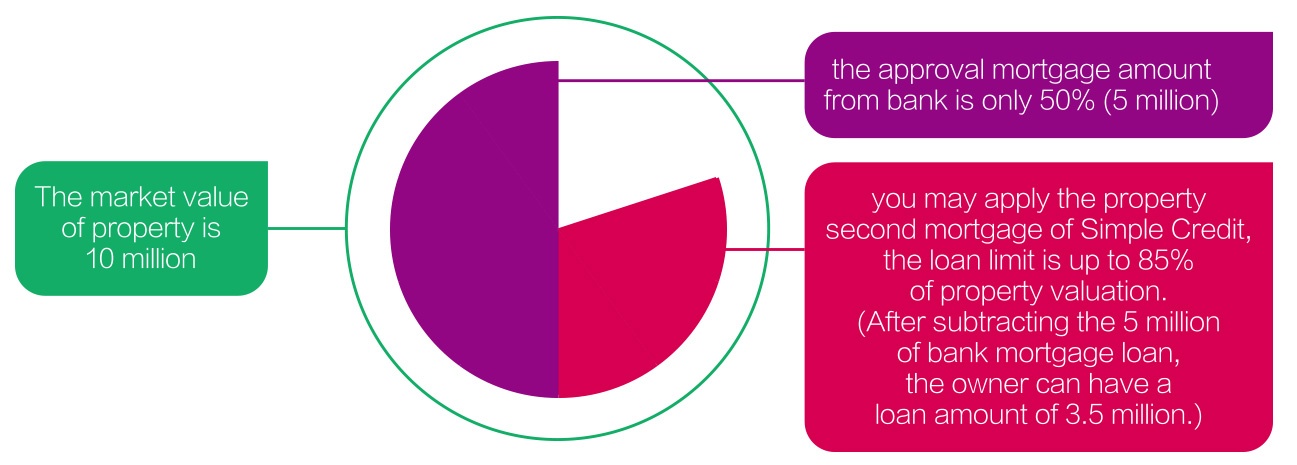

Example:

Supposing you are buying a 10 million property, but the approval mortgage amount from bank is only 50% (5 million). If you preferred a steady cash flow, you may apply the property second mortgage of Simple Credit, the loan limit is up to 85% of property valuation. (After subtracting the 5 million of bank mortgage loan, the owner can have a loan amount of 3.5 million.) The procedure is simply and fast, and will be finished at the same time to bank’s loan on the deal day.